horsemen's bookkeeper

Contact us | disbursements/check requests | ACH/Electronic Disbursement |Tax forms|WIRE TRANSFER| PARTNERSHIPS | purse distribution

Horsemen's Bookkeeper

Office Hours

The Horsemen’s Bookkeepers’ office is located inside the racing office and will be open from 8:30 am until after the last race on live racing days.

Disbursements/Check Requests

Purse funds are available 48 hours after the race and may be requested in person, by email or phone.

*A tax form must be on file before any funds will be released for disbursement (See Tax Forms below)

During the meet

Payments are processed on Tuesday and Friday mornings during the race meet. Since Tuesday is a dark day (non-racing day), checks processed on Tuesday are available for pick up Wednesday mornings at the racing office. Checks processed on Friday are available at the racing office after 12:00 pm that same day.

OffSeason

Payments are processed on Tuesdays when racing is not in season.

ACH/Electronic Disbursement

Horsemen may elect to receive purse funds electronically through Automated Clearing House (ACH). An ACH enrollment form must be on file with the Horsemen’s Bookkeeper in order to utilize this process.

Tax Forms

A tax ID (SSN or FEIN) is required before any funds can be released. An IRS form W-9, W-8ECI or W-8BEN certifying the tax ID must be submitted to “Keeneland Association, Inc.” In the case of partnership accounts, a W-9 is required from ONLY ONE of the partners and all income for the account will be reported to the IRS using that partner’s tax ID.

United States Residents – Horsemen must have a signed W-9 on file with the Horsemen’s Bookkeeper before any purse money will be distributed.

United States Non-Residents - The Internal Revenue Service requires that Keeneland withhold and pay 30% of purses paid to a non-resident of the United States, if the person paid does not possess a valid Federal Taxpayer Identification Number, to the IRS. Each non-resident must submit a completed W-8ECI or W-8BEN to the Horsemen’s Bookkeeper.

Tax forms can be picked up at the Horsemen’s Bookkeeper office. Completed Forms can be dropped off or emailed to [email protected].

Wire Instructions for Funding Keeneland Account

Email [email protected] or call (859) 280-4748 for wire transfer instructions.

All funds, including 6% sales tax, must be available on the horsemen account prior to a claim.

Complimentary Wire Transfer to Churchill Downs

As a courtesy to our horsemen upon request, Keeneland will wire funds to Churchill Downs at the conclusion of our meet. If you would like to participate, please notify the Horsemen’s Bookkeeper prior to closing day.

Note: A W-9 is required for each account that requests this service.

Partnerships

If a horse runs in the name of a partnership, the check will be issued in the name(s) of those listed on the designated partnership account. The Horsemen’s Bookkeeper will not pay out percentages to different partners; it is the responsibility of the partnership to disperse funds accordingly.

Purse Distribution

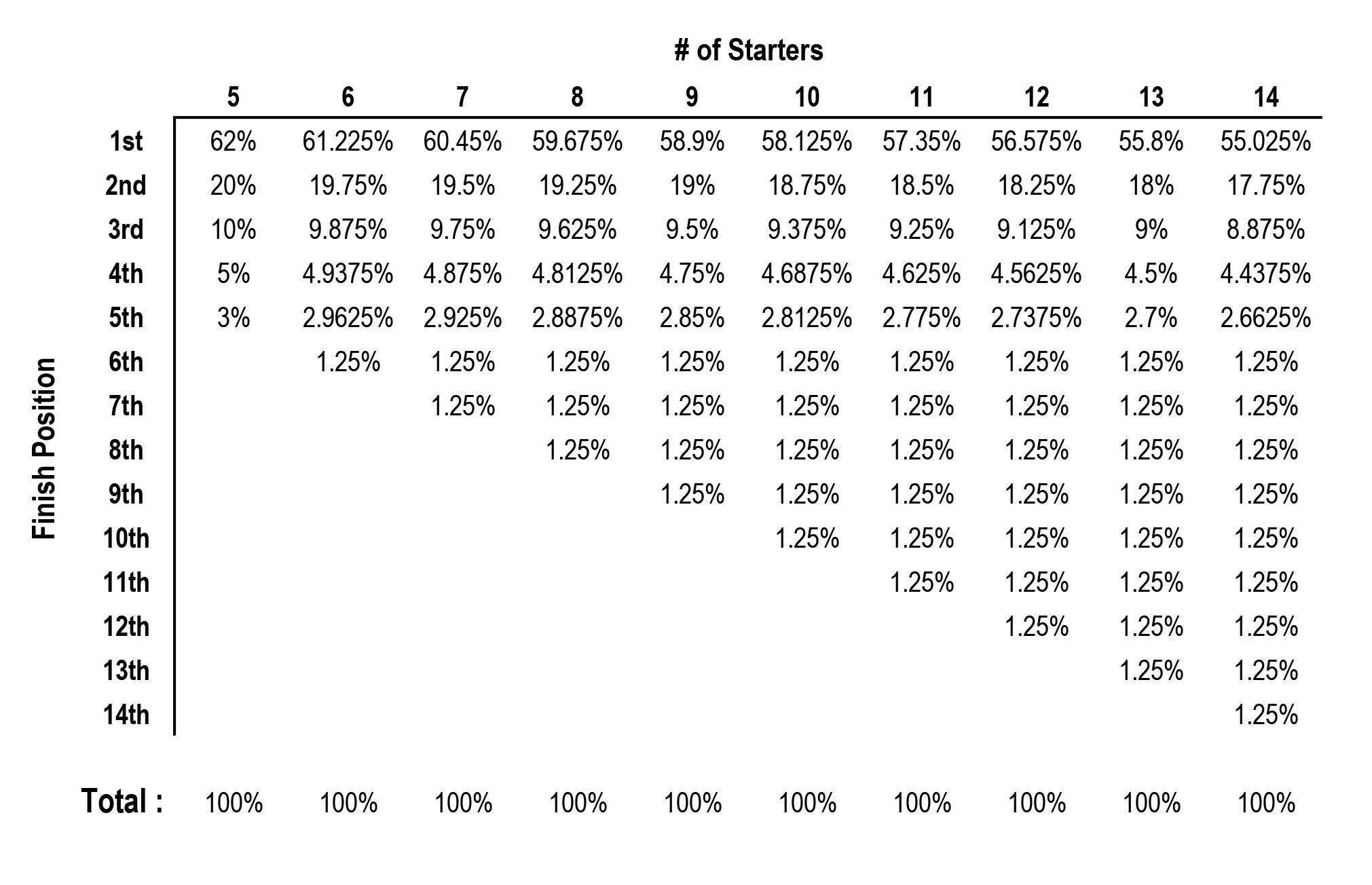

After payment of 1.25% to all owners of horses finishing 6th through last place, the remaining Association purse will be divided:

62% to the owner of the winning horse

20% to the owner of the 2nd place finisher

10% to the owner of the 3rd place finisher

5% to the owner of the 4th place finisher

3% to the owner of the 5th place finisher